Capital expenditure capex is a payment for goods or services recorded or capitalized on the balance sheet instead of expensed on the income statement.

Capex spending sheet metal percent.

Even so capital equipment spending projections in the metal fabrication space remain healthy beating broader capex trends.

Put another way it is an expenditure that is capitalized i e not expensed directly on the income statement and is considered an investment.

Steps to calculate capital expenditure capex the calculation of capital expenditure formula can be done by using the following three steps.

Firstly the pp e value at the beginning of the year and the end of the year is collected from the asset side of the balance sheet.

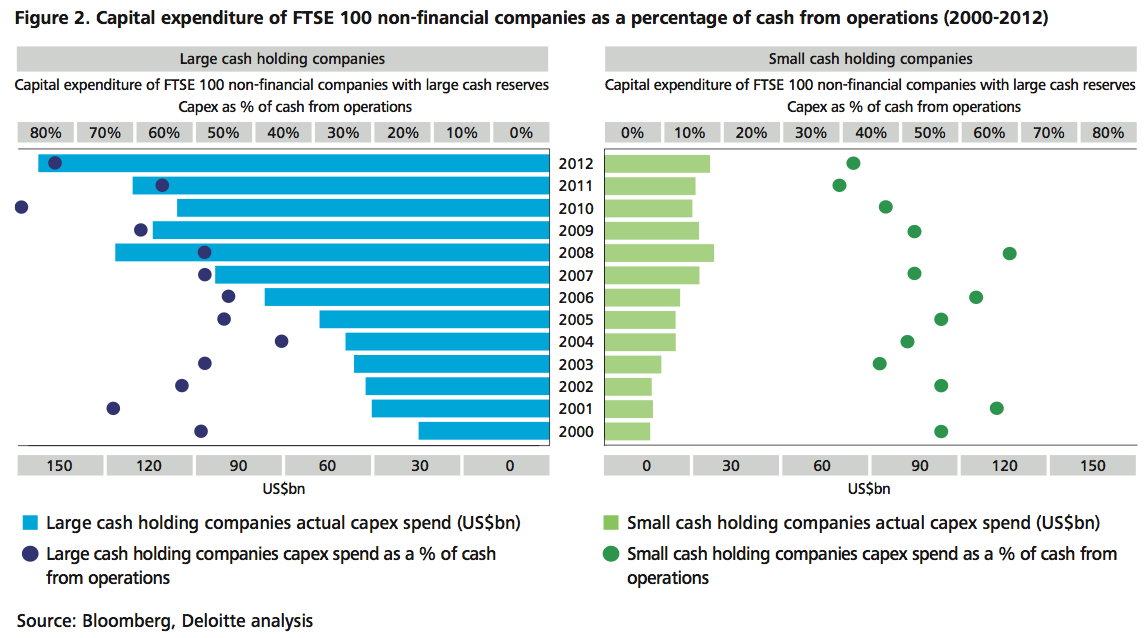

However there is significant variance by industry.

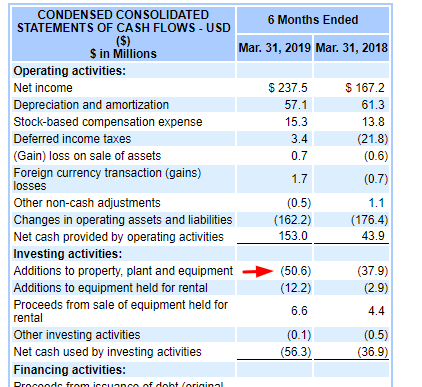

Here is an example of how to calculate capital expenditures as it applies to financial modeling in excel.

A capital expenditure capex for short is the payment with either cash or credit to purchase goods or services that are capitalized on the balance sheet.

Cfi s financial modeling courses.

From the example mentioned above the calculation of capex capital expenditure made by the company can be done as under.

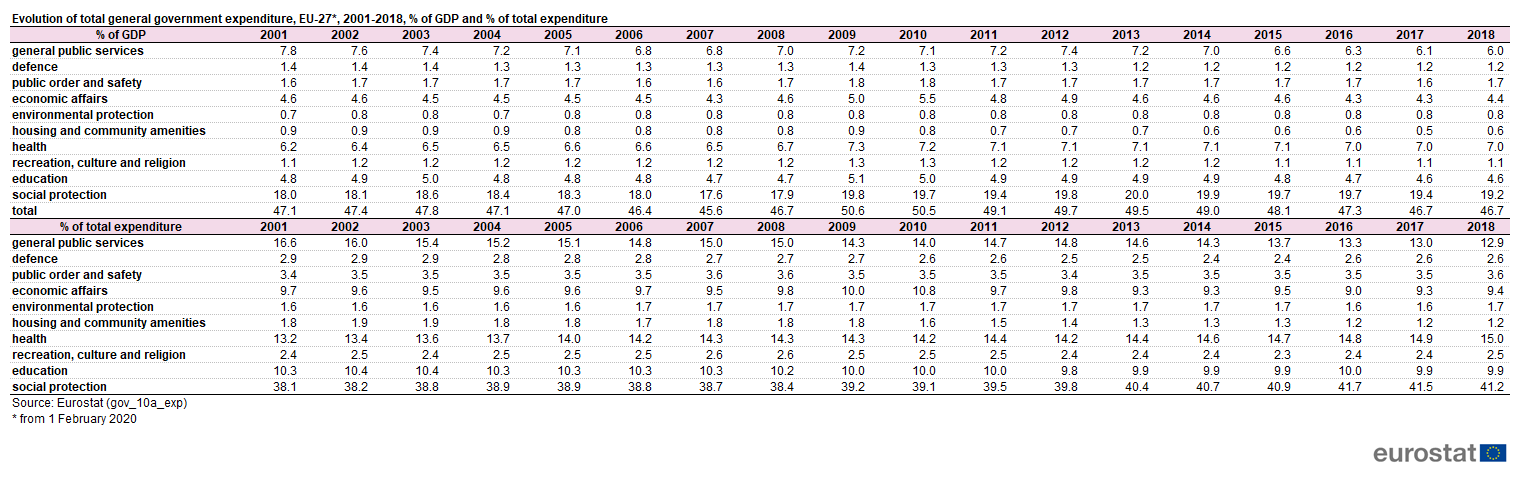

Results from this year s 2016 capital spending forecast from fma which tracks spending trends for metal fabricators in the u s imply that fabricators continue to shorten that cycle.

2018 depreciation is 15 005 on the income statement.

Capex for our sample of 16 000 companies came in at a median average of 3 7 of sales between 2010 and 2015.

Capex made by an entity is majorly reflected in the non current assets property plant and equipment section of the balance sheet of the.

Projected numbers for total spending are up only a little over 2 percent over last year s report for a total of 2 3 billion.

Capital intensive industries such as electric utility and oil gas generally report higher levels of capex compared to asset light industries such as it services as figure 91 shows.

Amount of capex made 1013 46.

Then the net increase in pp e value is calculated by deducting the pp e value at the beginning of the year from.

Operating expenditures expenses represent day to day costs that are necessary to keep a business running.

Amount of capex made 1136 78 123 32.

According to the 2020 capital spending forecast equipment spending is holding steady not a bad outlook taking into account the record high spending projections during the past few years.

Current period 2018 pp e is 37 508 on the balance sheet.

:max_bytes(150000):strip_icc()/TSLACF-----063329aec6ea4dabb3170b1e65b8246d.jpg)