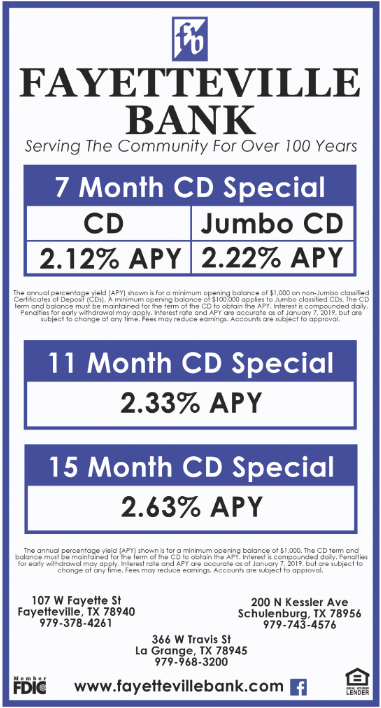

Jumbo certificates of deposit cds usually require a large amount of money think 100 000 and can sometimes offer even higher interest rates than regular cds but usually only within a given bank.

Cd rates 1 year jumbo.

1 25 apy 100 000 minimum deposit for apy golden 1 credit union.

A certificate of deposit or cd is a great place to store cash.

A jumbo certificate of deposit or jumbo cd is a cd that has a balance of at least 100 000.

Navy federal credit union.

1 year jumbo cd rates at synchrony bank were changed from 2 62 percent with a yield of 2 65 percent.

Follow synchrony bank cd rates for 1 year jumbo certificate of deposits are now at 2 71 percent with an apy of 2 75 percent.

Besides great jumbo cd rates and terms usaa offers tools and advice on a variety of financial products.

Jumbo cd rates vary from 0 08 for 30 days up to 1 11 for a five year term.

To highlight examples of the best jumbo cds moneyrates focused on the top 1 year and 5 year cds from its most recent rate survey.

The minimum deposit is 95 000 up to a maximum of 174 999.

Usaa offers standard jumbo and super jumbo cds for military members and their families.

Cd rates could change significantly in a year and you might not want to miss out on a.

Current rates on jumbo cds tend to be around 0 05 to 0 10 higher than regular cds while the difference between their minimum deposit requirements is huge.

1 20 apy 100 000 minimum deposit for apy.

Bankrate s best 5 year jumbo cd rates for october 2020.

The products and rates were verified to make sure they would apply to jumbo accounts those in excess of 100 000.

Compare synchrony bank cd rates for 1 year jumbo certificates of deposit with other cd rates.

However banks and credit unions often compete more for the best cd rates for regular non jumbo cds and so as you ll see below the highest annual percentage yields apys offered on non.

At this level you can typically earn a higher amount of interest on your cd versus another cd with a lower deposit amount.

One year cd rates can help boost some of your short term savings.

Typically not by much.